Ct Tax On Social Security 2025. As the rate of inflation moderates, the social security cola for 2025 might be 3%, according to the latest estimate from mary johnson, an independent social security. Under the existing tax structure, residents with incomes under $75,000 ($100,000 for a couple) are generally exempt from having to pay taxes on social security.

If allowable through filing, recipients are not subject to connecticut income tax on federally taxable social security benefits. The next president will be inaugurated on jan.

[Social Security Tax Explained] How Much State Tax Will I Pay on Social, Governor ned lamont today signed into law legislation enacting the fiscal years 2025 and 2025 biennial state budget, which contains several tax relief measures. Under the existing tax structure, residents with incomes under $75,000 ($100,000 for a couple) are generally exempt from having to pay taxes on social security.

![[Social Security Tax Explained] How Much State Tax Will I Pay on Social](https://i.ytimg.com/vi/iLrapB2Ix7k/maxresdefault.jpg)

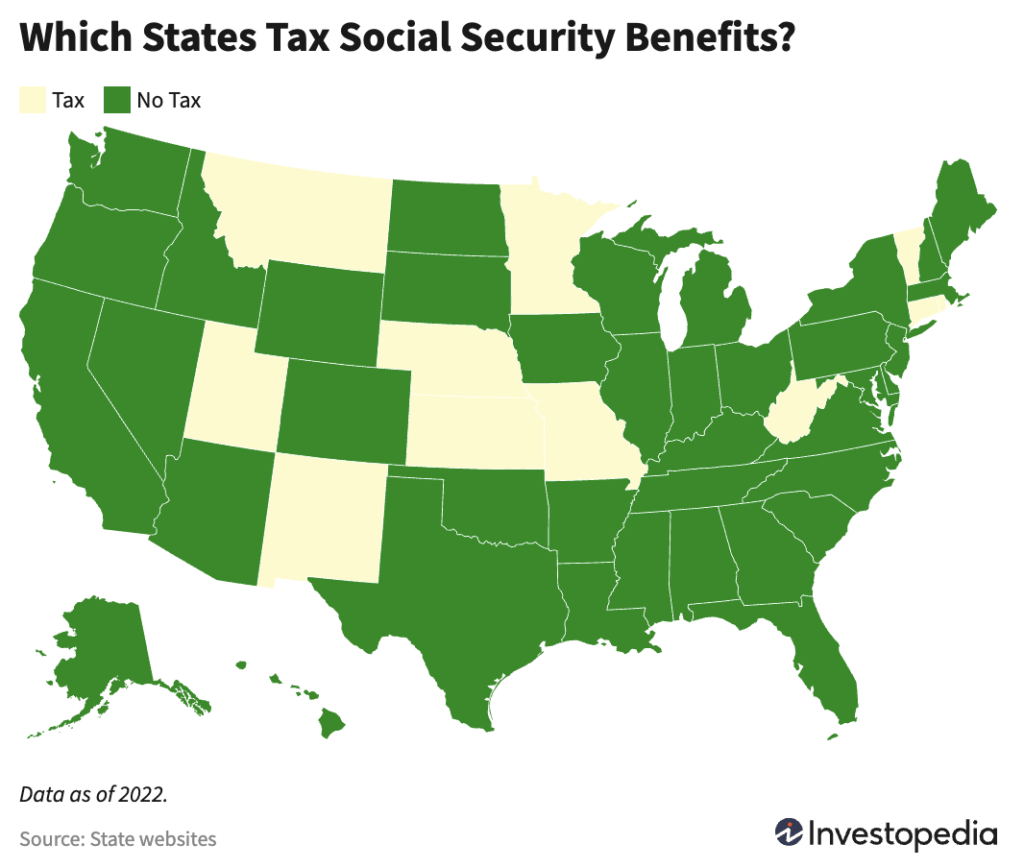

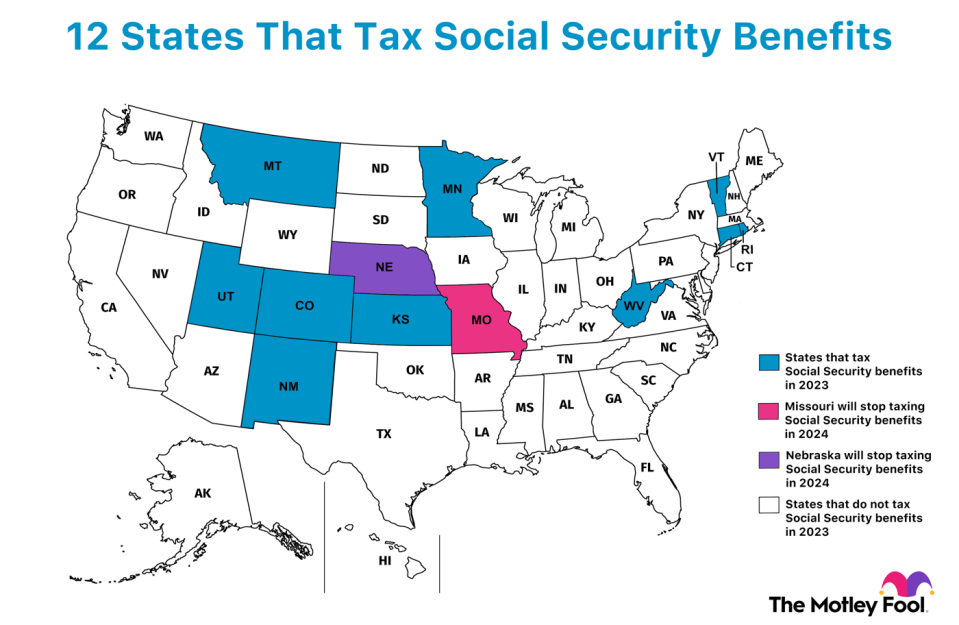

States That Tax Social Security Benefits Markets Today US, Under the existing tax structure, residents with incomes under $75,000 ($100,000 for a couple) are generally exempt from having to pay taxes on social security. Effective in 2019, the threshold increases from $50,000 to $75,000 for single filers and married people filing separately, and $60,000 to $100,000 for joint filers and.

Social Security and Tax What You Need to Know, The current method for calculating connecticut income tax on retirement income is deeply flawed. The state exempts 100% of federally taxable social security income for single filers and married people filing separately whose federal adjusted gross income is.

Who Pays Taxes on Social Security And Why? Merkle Retirement Planning, As many are aware, in 2019 connecticut implemented. As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the.

Social Security Expansion Act 33.8 Trillion Tax Would Destroy Jobs, Is social security taxable in connecticut? Connecticut currently exempts from the state income tax all pension and annuity earnings — but only for individuals whose overall income from all sources is less than $75,000 per year.

Paying Taxes on Social Security Benefits What Retirees Must Know, (these exemptions apply only to state income taxes, not federal. Under the existing tax structure, residents with incomes under $75,000 ($100,000 for a couple) are generally exempt from having to pay taxes on social security.

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, As the rate of inflation moderates, the social security cola for 2025 might be 3%, according to the latest estimate from mary johnson, an independent social security. The budget is said to include the largest income tax cut in connecticut history and includes approximately $500 million in tax relief to connecticut taxpayers,.

How To Calculate, Find Social Security Tax Withholding Social, Did you know that connecticut law provides income tax exemptions for social security benefits, railroad retirement benefits, military retirement pay, pension and. 75% exemption in taxable year 2025.

Which states tax social security benefits in 2025 Internal Revenue, Under the existing tax structure, residents with incomes under $75,000 ($100,000 for a couple) are generally exempt from having to pay taxes on social security. Governor ned lamont today signed into law legislation enacting the fiscal years 2025 and 2025 biennial state budget, which contains several tax relief measures.

Most of Social Security's Comes from Payroll Tax Contributions, Did you know that connecticut law provides income tax exemptions for social security benefits, railroad retirement benefits, military retirement pay, pension and. Governor ned lamont today signed into law legislation enacting the fiscal years 2025 and 2025 biennial state budget, which contains several tax relief measures.

Governor ned lamont today signed into law legislation enacting the fiscal years 2025 and 2025 biennial state budget, which contains several tax relief measures.

Did you know that connecticut law provides income tax exemptions for social security benefits, railroad retirement benefits, military retirement pay, pension and.