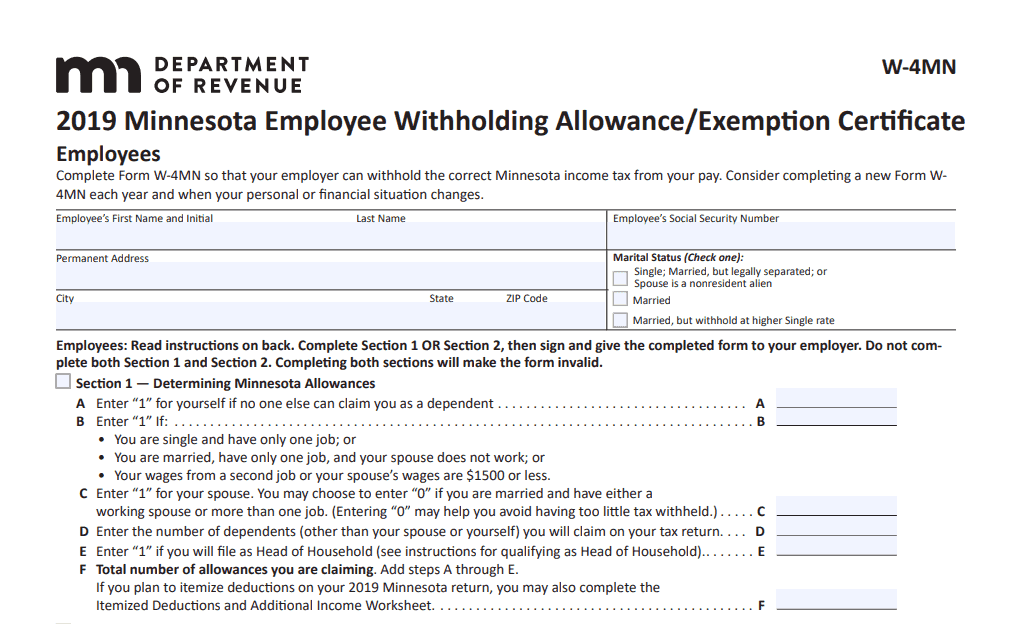

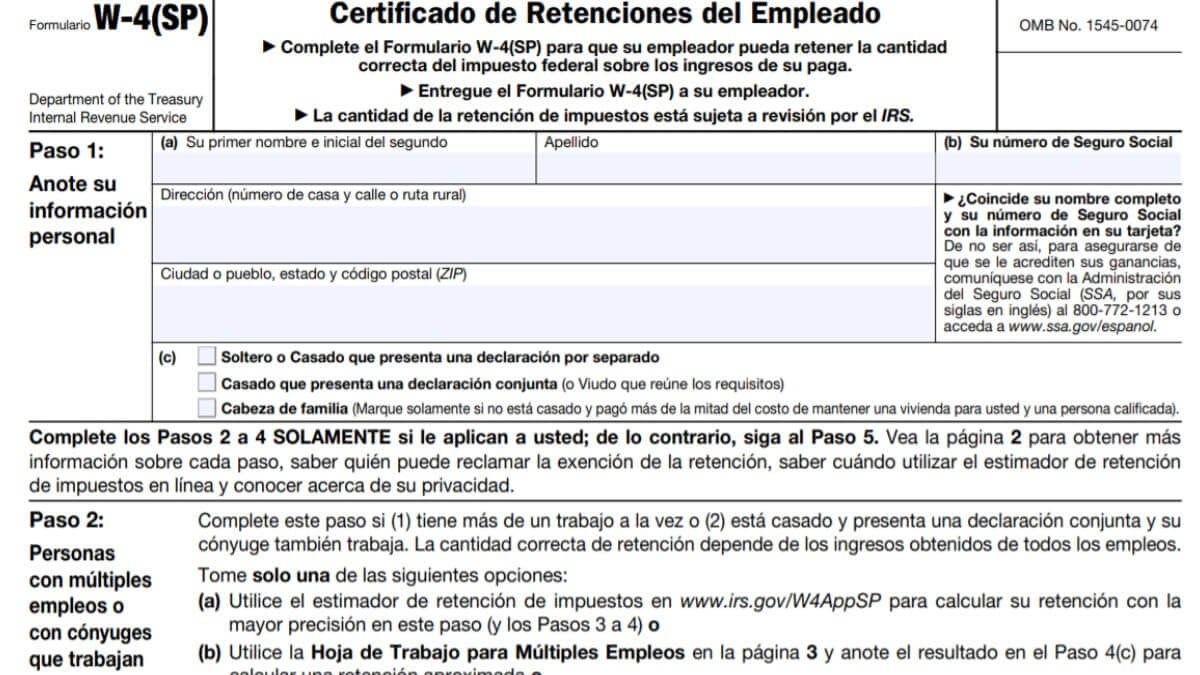

2025 W4 Minnesota. In minnesota, your employer will deduct money to put toward your state income taxes. This calculator allows you to calculate federal and state withholding for the state of minnesota.

Your employee claims more than 10 minnesota withholding allowances. Employers use the information on.

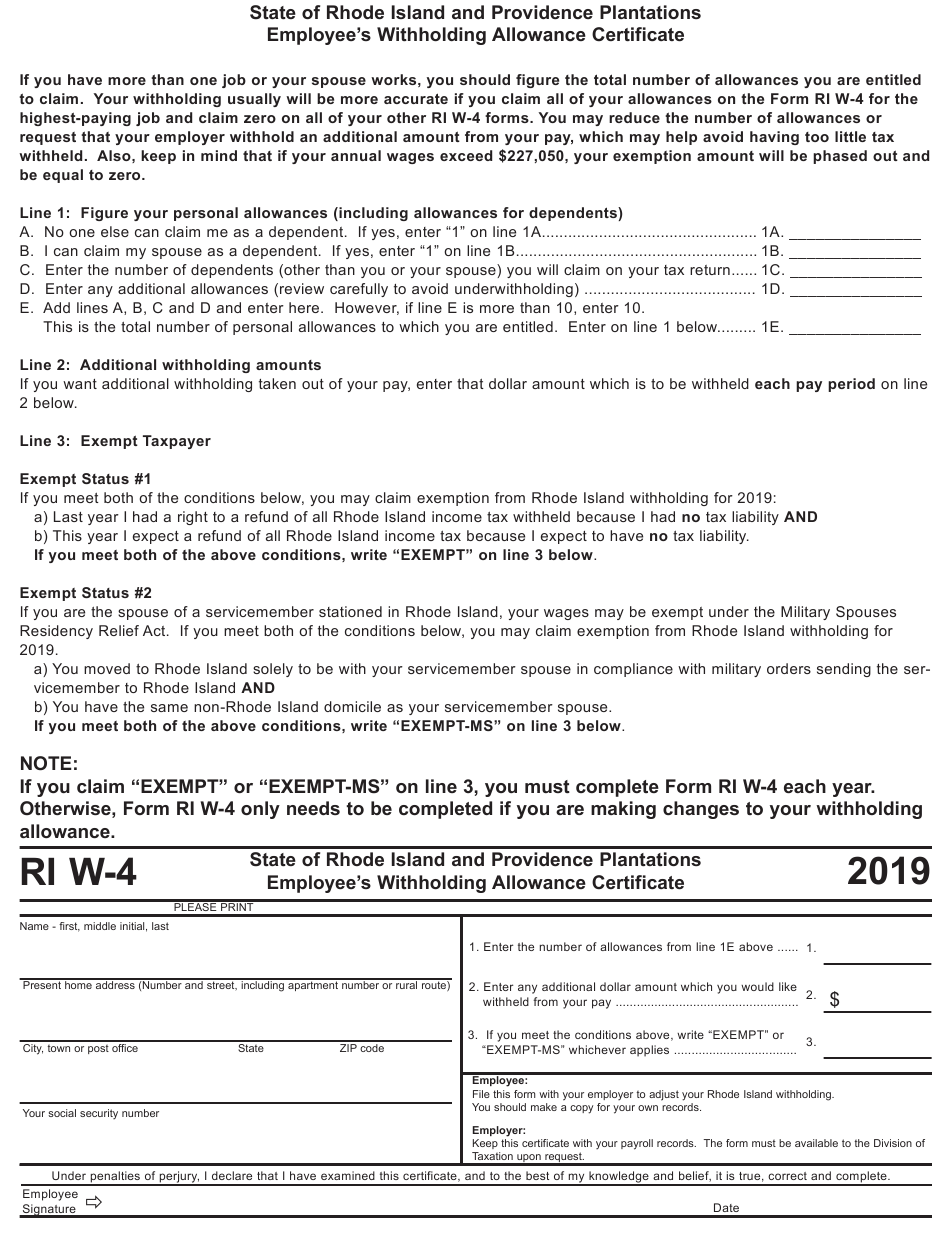

Federal income tax (10% to 37%) state income tax (5.35% to 9.85%) social security (6.2%) medicare (1.45% to 2.35%) the.

W4 Form 2025 Mn Genni Josepha, Your employee claims to be exempt. All personal service income earned in minnesota will be reported to minnesota.

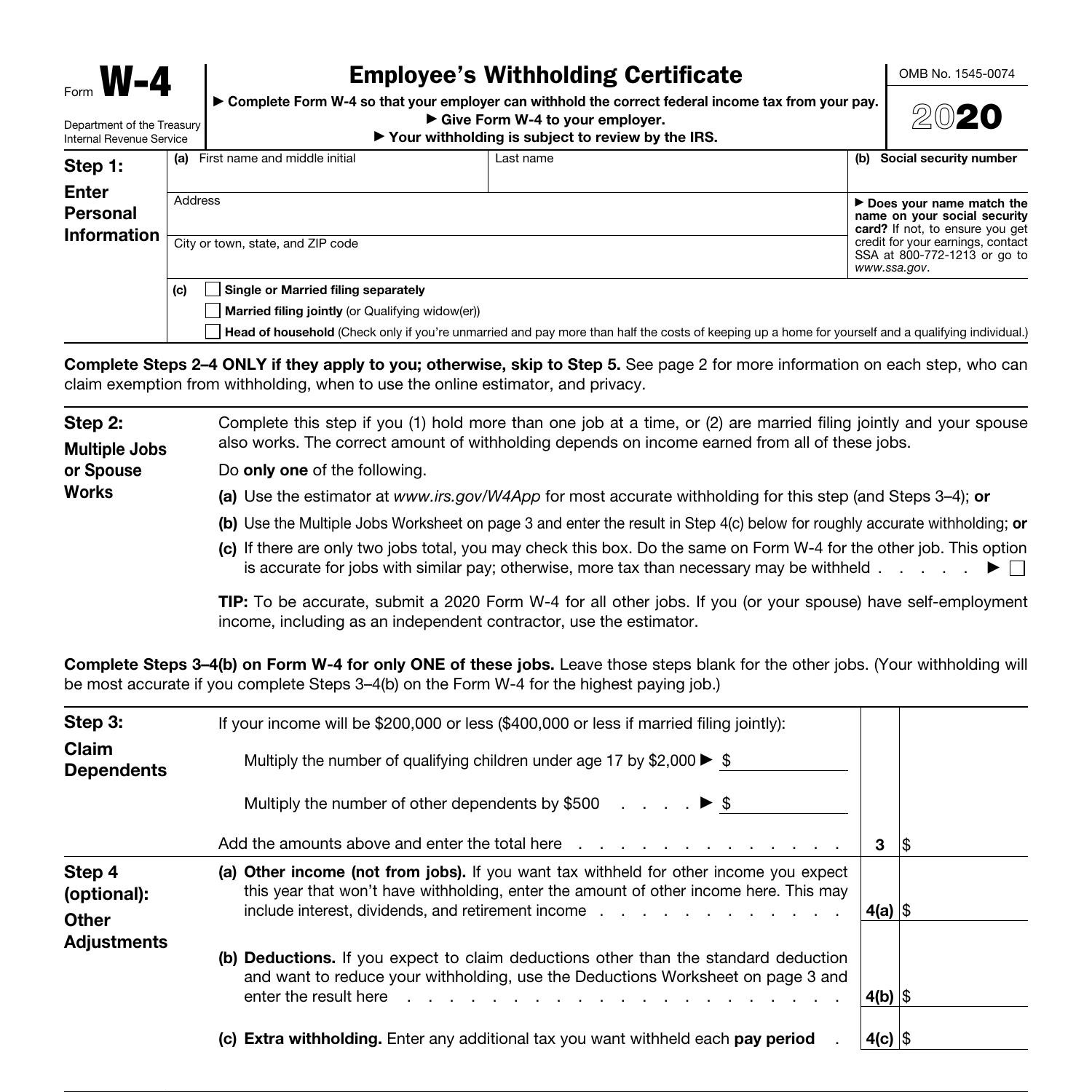

W4 2025 Mn Wilma Juliette, You can pick up forms at our. Payroll check calculator is updated for payroll year 2025 and new w4.

W4 2025 Mn Wilma Juliette, Withholding tax applies to almost all payments made to. It also does fica, medicare, and employer paid taxes.

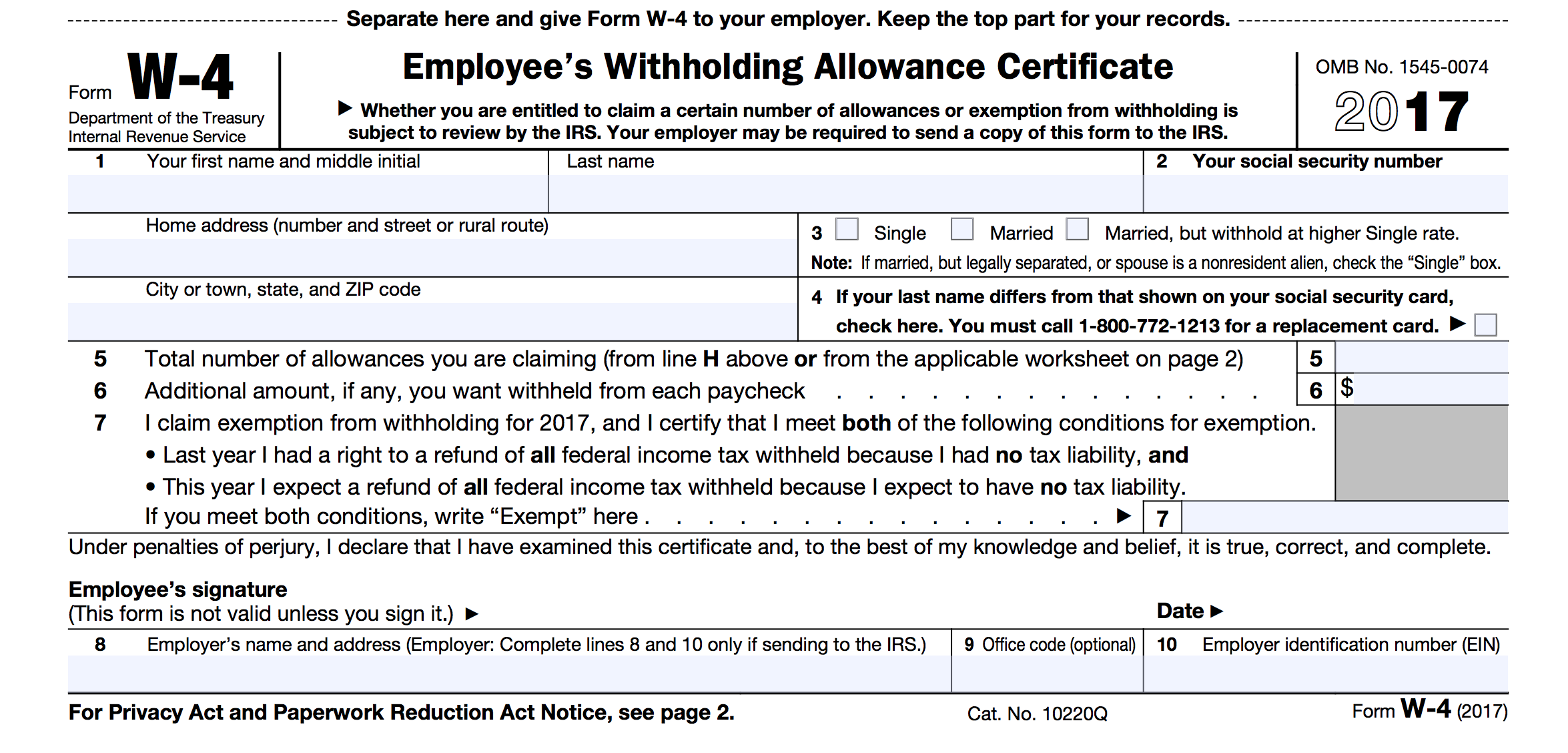

2025 W4 Tax Form Athene Anabella, The taxes on your paycheck include. You will need to fill out your basic information:

Mn W4 Form 2025 Lorna Rebecca, Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state. Federal income tax (10% to 37%) state income tax (5.35% to 9.85%) social security (6.2%) medicare (1.45% to 2.35%) the.

2025 Minnesota W4 Maria Stormi, You can get minnesota tax forms either by mail or in person. For each withholding allowance you claim, you reduce.

W4 Form 2025 Instructions In Pavla Beverley, For each withholding allowance you claim, you reduce. The taxes on your paycheck include.

W4 Form 2025 State Sybil Kimberlyn, You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. Your employee claims to be exempt.

W4 2025 Printable Spanish Ester Janelle, Federal income tax (10% to 37%) state income tax (5.35% to 9.85%) social security (6.2%) medicare (1.45% to 2.35%) the. You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents.

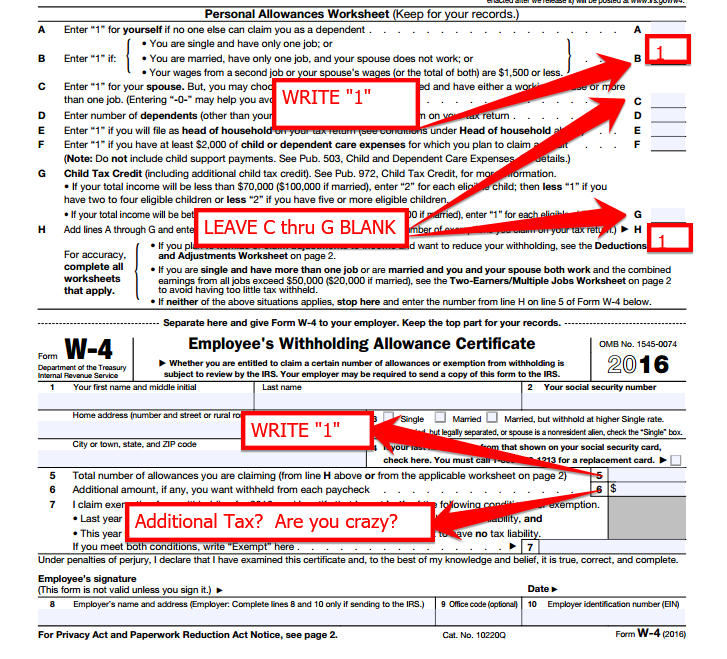

How to do Stuff Simple way to fill out a W4, File a 2025 minnesota income tax return in 2025 as a nonresident. You can get minnesota tax forms either by mail or in person.

Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state.